Cybersecurity plays a vital role in any Merger and Acquisition (M&A) as it protects invaluable intellectual property, sensitive client data, and personal information.

Despite the COVID-19 Pandemic, M&A market has been very active in several industries including, Fintech, Banking, Insurance, Healthcare, and IT Consulting. Regardless of the industry, organizations face a multitude of cyber security threats when engaging in M&A activities. Some common threats include:

- Bad Acquisitions: Takeover of companies with poor cyber security and privacy hygiene.

- Internal and External Threats: Former employees, disgruntled staff members or hackers and activists targeting the company or management.

- Legal and Regulatory Fines: Regulators issuing heavy fines for non-compliance with regulations.

- Security Gaps: Unreported data breaches or other cyber security gaps.

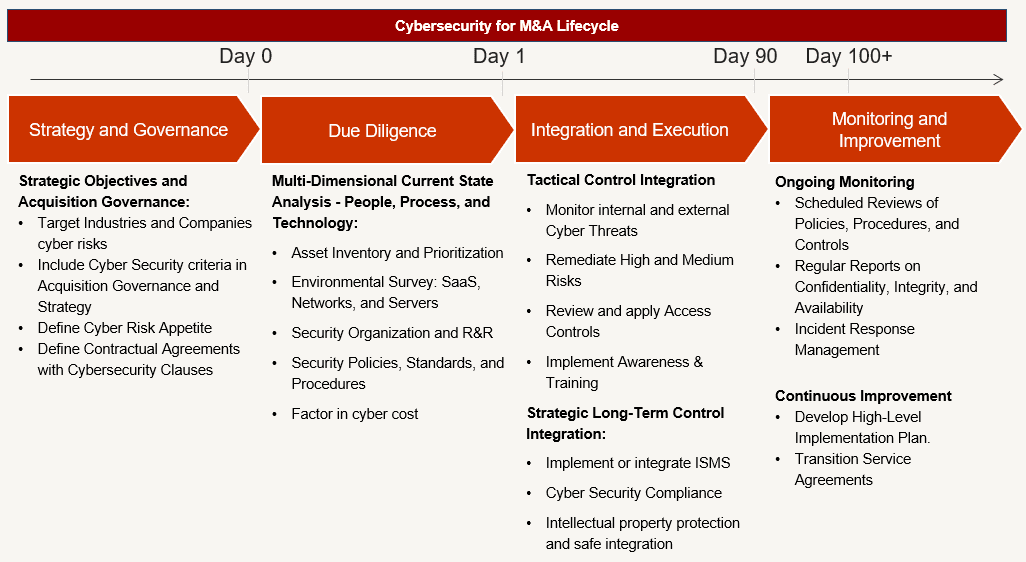

From the moment of searching for the target companies to deal finalization and integration, it’s critical to capture and manage the cyber security profile of any target company. Organizations must define cyber security criteria, like the cost of cyber security controls and security incidents, throughout the M&A lifecycle, including the target identification process, due diligence, integration, and ongoing monitoring. Experience shows that cyber security threats and risks are amplified both ‘during’ and ‘after’ an acquisition and its integration. Most target acquisitions experience extreme cyber threats during and immediately after M&A activities impacting negotiations and deal value.

Organizations require a customizable cyber security framework to guide them through the M&A process from the ‘Identification’ phase to ‘Due Diligence’, ‘Integration and Execution’, and ‘Monitoring and Improvement’. Some of the key activities are depicted below:

Management Questions:

Management should consider answering the following seven questions while embarking on M&A activities:

- What cyber security practices should we adopt in our Acquisition Strategy and Governance?

- What are the cyber threats and risks for our target industry or companies?

- What cyber security criteria and activities should we consider in the selection, due diligence, and integration process?

- What are the fees we should factor into our acquisition budget for mitigating cyber risks?

- What are the tactical controls that must be implemented immediately after acquisition versus longer term controls?

- What should we monitor during the M&A process?

- What are our cyber security regulatory and privacy compliance obligations and how do we manage them?

For further information on our M&A Cybersecurity Framework contact us at info@riskview.ca | 416-997-2824

RiskView, Inc.

2230 Lakeshore Blvd. West, Unit 3507, Toronto, Ontario, M8V0B2